As people age, selecting a Senior Insurance Plan becomes an important decision to make. It’s important to think about the type of insurance plan that best fits your needs and budget. There are a number of options available, so it can be tricky to choose the right one. In this article, we’ll discuss the different types of Senior Insurance Plans, the differences between Medicare and Medicaid, coverage options for different age groups, costs associated with senior insurance, and things to consider when choosing a plan. We’ll also cover how to find the best Senior Insurance Plan for you. With the right information, you can make an informed decision that gives you peace of mind knowing you’re well protected.

Types of Senior Insurance Plans

When it comes to senior insurance plans, there are several to choose from. Generally, seniors look for plans that provide basic coverage like medical and hospitalization, dental, vision and hearing. However, depending on individual needs, plans vary and may cover additional services such as prescription drugs, home healthcare and long-term care. The most common types of senior insurance plans are Medicare, Medicaid, supplemental, long-term care and life insurance.

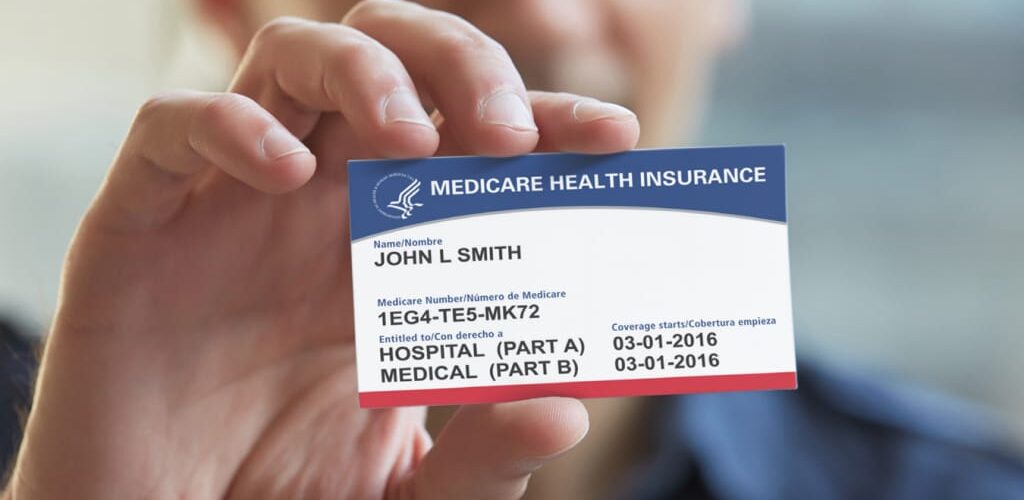

Medicare is federal health insurance for people over 65 years of age and those with disabilities. It offers protection from high medical bills through four parts – Hospital Insurance, Medical Insurance, Prescription Drug Coverage and Medicare Advantage Plans.

Medicaid is a state-run insurance program to assist those who cannot afford healthcare services. It pays medical bills for people with limited income and resources and covers doctor visits, hospital stays, prescription drugs and other services.

Supplemental insurance plans are for those who don’t have an existing insurance. These plans provide extra coverage such as dental, vision, disability, hospitalization, medication and other benefits to ensure that senior citizens don’t have to pay out-of-pocket expenses.

Long-term care plans cover long-term services such as nursing care, rehabilitation, and other specialized services. These plans pay for facilities, skilled nursing homes, or home health services when the primary insurance (like Medicare or Medicaid) does not fully cover these expenses.

Life insurance policies provide financial security for seniors and their families. They are usually in the form of term or universal life insurance. Term policies last for a fixed length of time, while universal plans offer more flexibility and higher premiums, allowing seniors to choose their coverage limits.

Choosing the right senior insurance plan for your age group depends on individual needs, budget and preferences. Careful consideration of each option helps seniors to select the most suitable plan that covers the services they require.

Understanding Your Health Needs

When choosing the right Senior Insurance Plan for your age group, prioritize understanding your health needs. Assess your current medical situation and anticipate potential future needs, considering both short-term and long-term perspectives. Take into account both physical and mental health aspects, using this information to evaluate which Senior Insurance Plans offer optimal coverage and assistance. Conduct thorough research on various insurance providers, posing essential questions for each plan. Inquire about covered services, potential pre-existing conditions, waiting periods for specific treatments, and identify costs not covered. Establish a comprehensive understanding of inclusions and exclusions in each plan to make an informed decision that aligns with your health requirements.

Differences between Medicare and Medicaid

When selecting an appropriate Senior Insurance Plan, it’s crucial to grasp the significant distinctions between Medicare and Medicaid. These programs markedly differ in eligibility criteria, coverage scope, and cost structures. Medicare, a federal initiative, is tailored for individuals aged 65 and above. Conversely, Medicaid operates predominantly at the state level, targeting low-income households, seniors, children, pregnant women, and individuals with disabilities.

In terms of eligibility, Medicare is generally extended to all persons over 65, regardless of income. Eligibility requirements for Medicaid, on the other hand, vary based on the state in which the recipient lives and their income level. For seniors, the requirements typically involve a combination of factors such as age, income, resources, and assets.

Additionally, Medicare tends to offer more comprehensive coverage than Medicaid and is designed to cover a larger range of medical expenses. Medicare generally covers doctor visits, hospital stays, preventative care, and prescription drugs. Medicaid, on the other hand, may only cover certain medical services if the state deems them medically necessary.

Finally, Medicare is generally more expensive than Medicaid and may require higher payments for insurance premiums, deductibles, and copayments. For those enrolled in Medicaid, however, there may be little or no cost involved as premiums and co-pays are waived or reduced for certain low-income beneficiaries.

In general, understanding the differences between Medicare and Medicaid is essential when choosing the right Senior Insurance Plan. It is important to thoroughly research to determine which type of insurance is the most appropriate for your individual needs and circumstances.

For more information about the differences between Medicare and Medicaid, readers may find useful information from Medicare.gov. This website, provided by the U.S. Department of Health and Human Services, is a helpful resource for understanding the different types of insurance coverage available to seniors as well as the eligibility requirements, cost, and other key factors.

Coverage for Different Age Groups

When finding the right senior insurance plan, consider the varying age groups, each with distinct medical coverage needs. Tailoring insurance policies to address these needs ensures that individuals of all ages can find the plan that best suits them.

Generally, plans can be tailored to fit the needs of those between 60 and 70, 70 and 80, or 80 and above. For seniors over 60, coverage might include things like vision and hearing care, dental services, and preventive care. Those between 70 and 80 may benefit from additional coverage for long-term nursing care or specialized treatments.

For those 80 and above, plans may include cancer screenings and additional coverage to manage chronic conditions like diabetes or high blood pressure. Senior insurance plans vary greatly depending on age, so it is important to research and compare other available options to make sure you are getting the coverage that best meets your personal needs.

Cost of Senior Insurance Plans

The cost of a Senior Insurance Plan is one of the most important considerations for every person in this age group. Costs can vary depending on the plan’s coverage, with plans providing fewer benefits costing less compared to those that offer comprehensive coverage.

Generally, Medicare and Medicaid plans tend to be the most affordable, while private supplemental plans cost more. Knowing your health needs and budget will help you to decide the best option for you. It is important to note that while premiums associated with private insurance plans may be higher, they often cover more. Some of the possible costs associated with Senior Insurance Plans include monthly premiums, deductibles, coinsurance and copayments. Additionally, if you are over 65 and haven’t signed up for Medicare yet, penalties may apply.

It is also essential to remember that Medicare and Medicaid require annual review and enrollment, so the associated costs may change from year to year. To understand the various prices more thoroughly, get pay attention to details and talk to a knowledgeable insurance agent.

Things to Consider when Choosing a Plan

When you’re considering a Senior Insurance plan, there are a few key things to consider. Firstly, you should assess your overall health needs. Make sure you understand the level of coverage that is required for your individual health concerns.

You should also understand the difference between Medicare and Medicaid and what plan best suits your needs. It is essential to understand the coverage for different age groups so that you can select the plan which offers the most protection for you at your stage of life. Furthermore, make sure you consider the cost of the plan so that it fits into your budget. There may also be special options for seniors from certain providers which you should consider exploring.

Lastly, check if the plan covers long-term care, in case you may need it in the future. By looking into these factors, you will be better equipped to choose the right Senior Insurance plan for you.

Finding the Right Plan

Finding the right Senior Insurance Plan can be tricky. It’s important to do your research and make sure you understand fully what coverage and options are offered. While it’s best to consult with an insurance professional for your specific situation, here are some top tips to finding the best plan.

Start by understanding your current health needs and any past medical conditions. Next, compare different types of plans and compare them side-by-side to find the best fit. Finally, take into consideration the cost of premiums, co-insurance, and deductibles.

When considering a Senior Insurance Plan, it is essential to consult with an insurance professional, especially if you are a Medicare or Medicaid beneficiary. Ultimately, it is essential to find a plan that fits your medical needs, budget, and lifestyle. With these tips, you can rest assured that you have taken the necessary steps to find the right Senior Insurance Plan for you.

Senior Insurance Plan – Conclusion

In conclusion, the key to choosing the right senior insurance plan depends on understanding you and your family’s specific needs. Your age group plays an important role in deciding the kind of coverage offered.

You must know the differences between Medicare and Medicaid to gain an overall understanding of the type of payment option available to you. Additionally, there are certain factors to consider such as cost and coverage when choosing an insurance option.

By taking your needs and preferences into account, you can select a senior insurance plan tailored to fit your needs.

We hope you enjoyed this article! If you’re looking for a comprehensive guide on planning for retirement, we suggest you check out this article Planning for Retirement: A Comprehensive Guide. Don’t miss out on your chance to learn about planning for your future, with one of the best guides online!